Tutorial: Setting up tax exempt/collect tax for B2C customers and 2 types of B2B customers:

- B2C Customers (normal customers): include tax.

- B2B Customers from Germany: include tax.

- B2B Customers from other countries: exclude tax.

For example, traders from Germany & traders from other countries in EU:

- normal customers (B2C customers): include tax.

- Traders from Germany: include VAT.

- Traders from other countries in EU: exclude VAT.

For this circumstance, we highly recommend using these modules:

- Custom pricing (set up custom prices for B2B Customers)

- Wholesaler Registration Form (create custom registration form for B2B Customers)

- VAT Exempt and Tax Inc/Exc (calculate tax inc/exc for B2B/B2C Customers at checkout page)

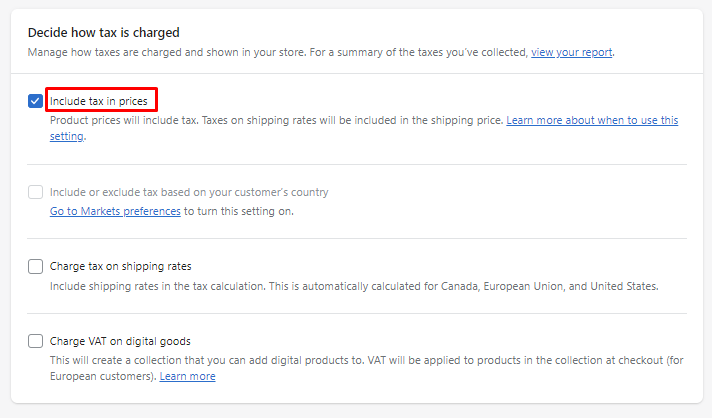

Step 1: Shopify Settings > Taxes > tick Include tax in prices

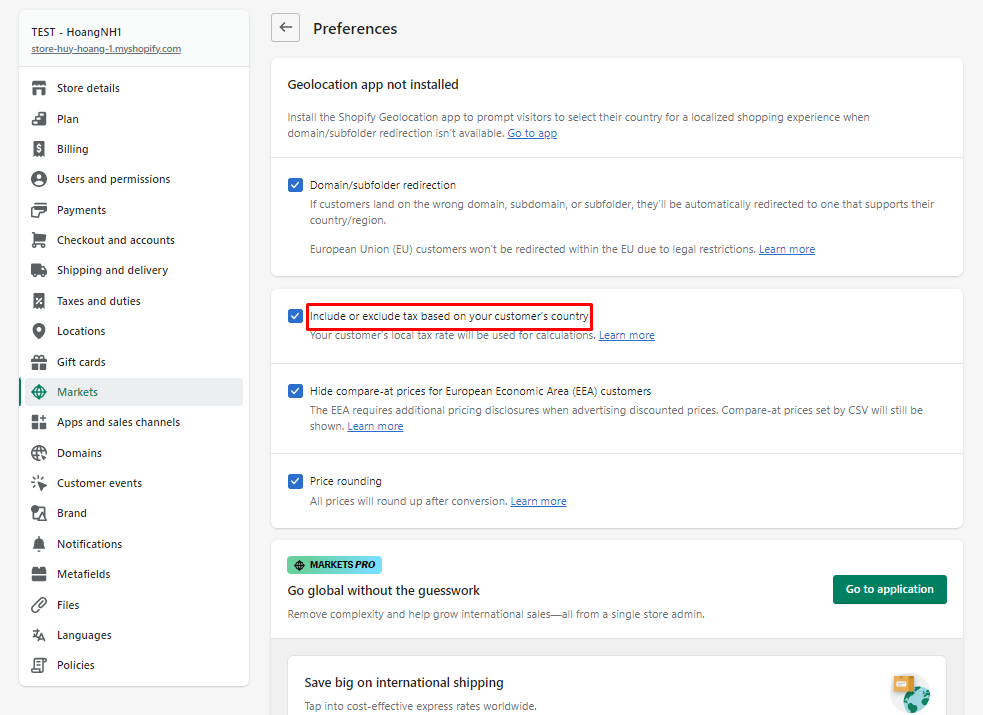

Step 2: Click Go to Markets preferences > tick Include or exclude tax based on your customer's country

Remember to set up taxes in EU

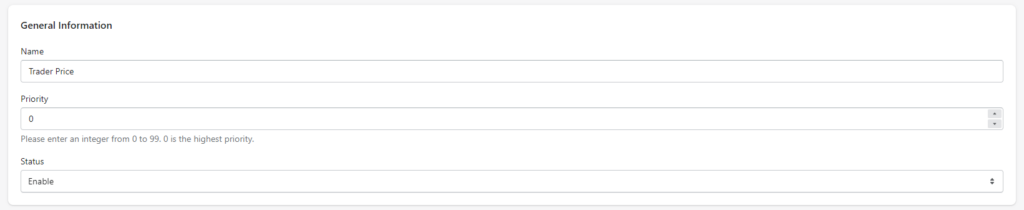

Step 2: Setting up Custom pricing rule for trader

- Enable Custom Pricing in Dashboard. If it's not working, please install it manually by following our instructions in the "CP Installation" tab.

- In "CP Rules" tab, Create new rule > Enter information

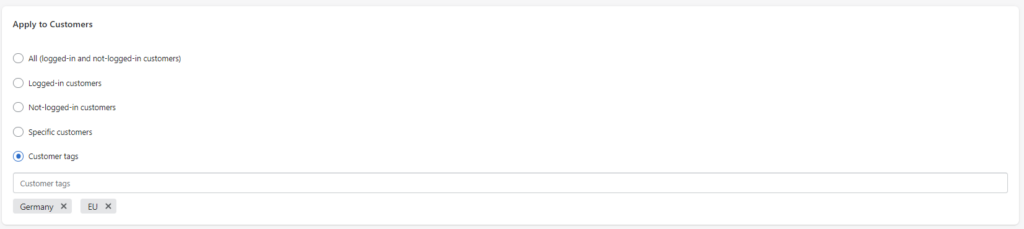

- Apply to Customers > Customer tags > Select the tags for trader (in both Germany and other States in EU)

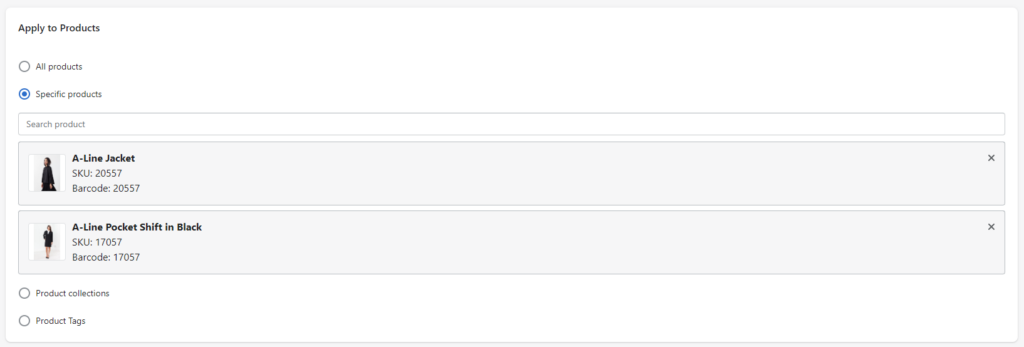

- Apply to Products: select the product you want to show as custom pricing for customers.

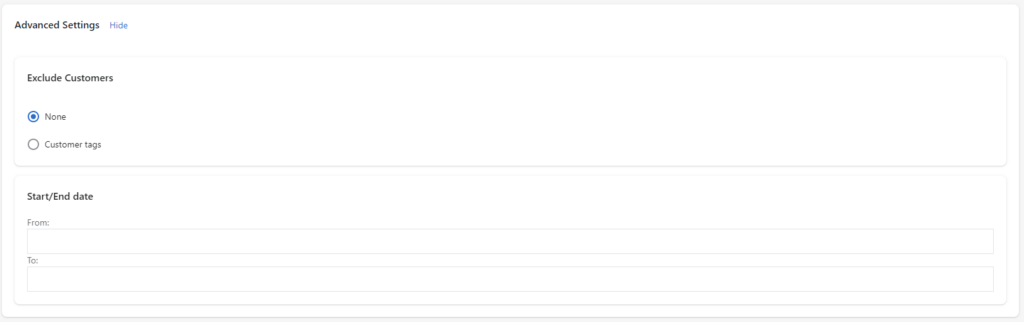

- Expand "Advanced Settings" to exclude customers and to choose the date when the rule is valid.

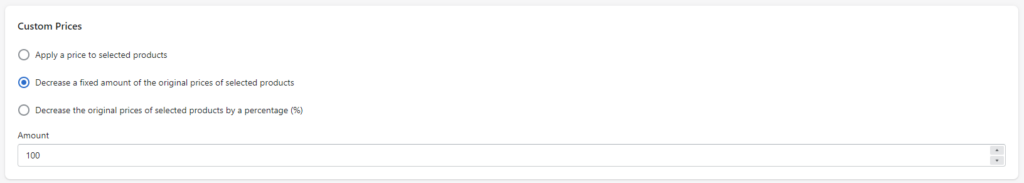

- Custom prices: select custom pricing options you want to set up (apply price/decrease fixed amount/decrease by percentage)

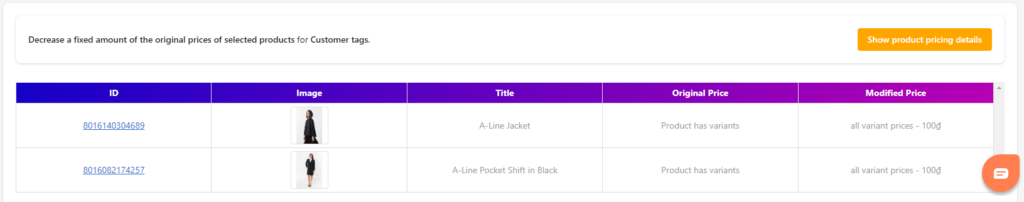

- Click "Show product pricing details" to show the custom pricing for products.

- Save

Step 3: Enable wholesale registration form & Tax Inc/Excl

- Enable "Wholesaler Registration Form" & "VAT EXEMPT AND TAX INC/EXCL" in Dashboard

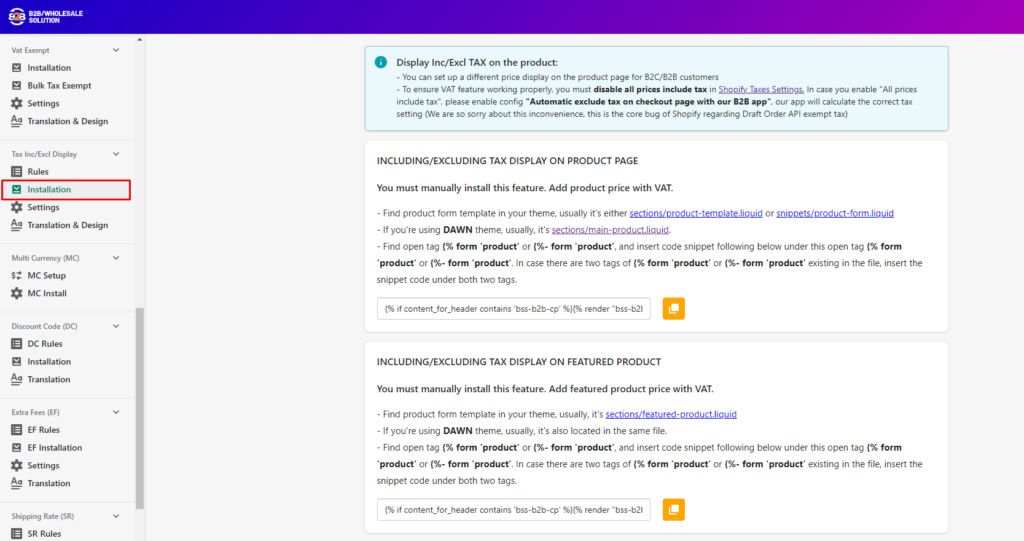

- In the "VAT EXEMPT'' tab, click "Installation" & follow the INC/EXCL Tax Display Installation instruction. You MUST install it manually so that this module works.

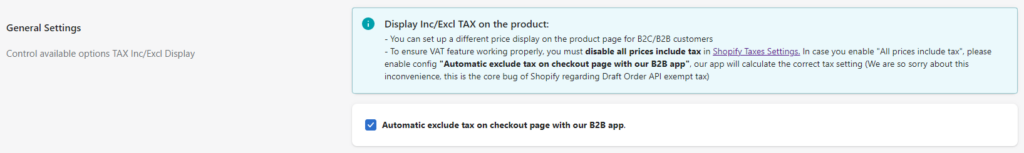

Note: If you tick “All prices include tax” in the Shopify Admin Settings, please go to "VAT EXEMPT'' tab > Settings > Tick “Automatic exclude tax on checkout page with our B2B app.”

Step 4: Setting up wholesale registration form for traders

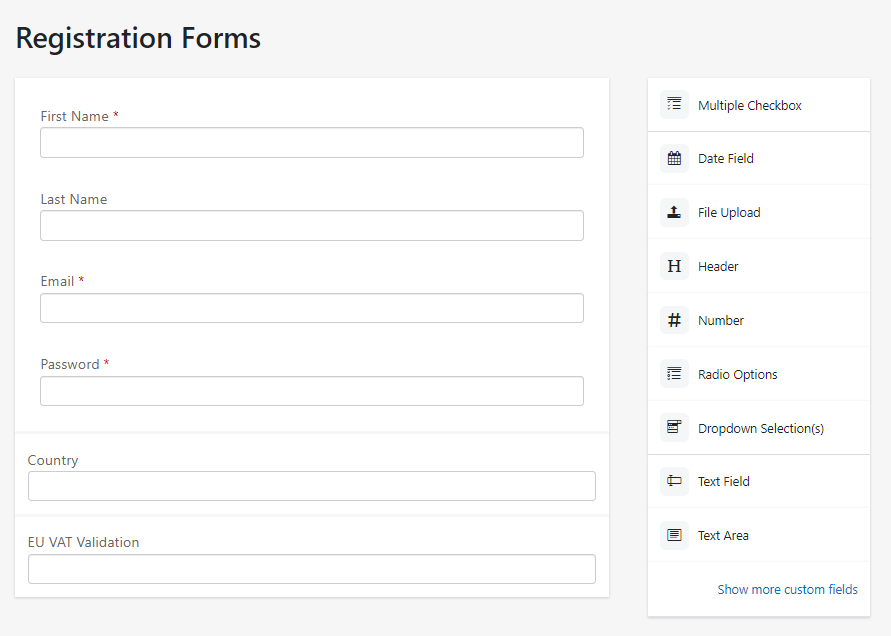

+ Create new form > enter form name & customize your form

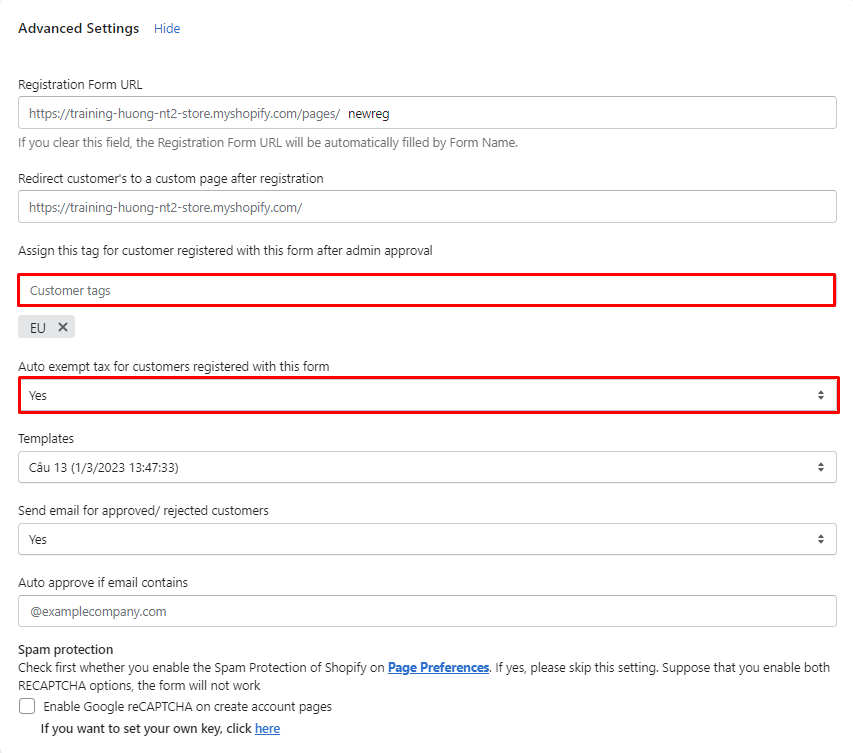

+ Advanced Settings > Assign this tag for customer registered with this form after admin approval > Select the tag you want to add for this customer group (“trader”) & select “Yes” for auto tax exempt. (for other countries in EU).

+ This form settings helps automatically exempt tax for customers from other countries in EU (except Germany). For German customers, we’ll do it in the next steps.

+ In Registration Forms, you should include “Country” and “EU Validation” fields to know where the B2B Customers come from.

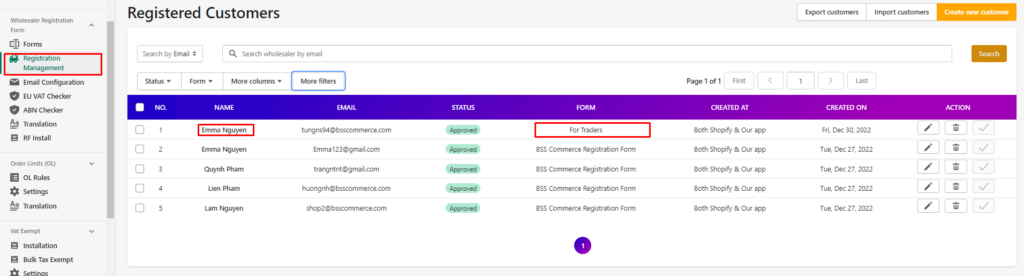

+ After customers register by this form, you can see the result in Registration Management tab in our app

+ For Austria customers (other EU customer), they are automatically exempted tax.

+ For German customer, you have to manually uncheck “Tax exempt” so that it is tax-included.

Result in product page: All customers will both see price inc/exc Tax display

Result in checkout page after entering Information (Country, postal code):

- German B2C Customers: Include tax

- Austria B2C Customers (Other countries in EU): Include tax

- German B2B Customers: Include tax

- Austria B2B Customers (Other Countries in EU): Exclude tax

Note:

- After setting up, please wait 15mins for this setup to work properly.