Our B2B/Wholesale Solution app offers the Tax Exempt feature, which allows you to deduct tax for EU business customers if they have validated EU VAT numbers.

Please follow the instructions below to install the rule:

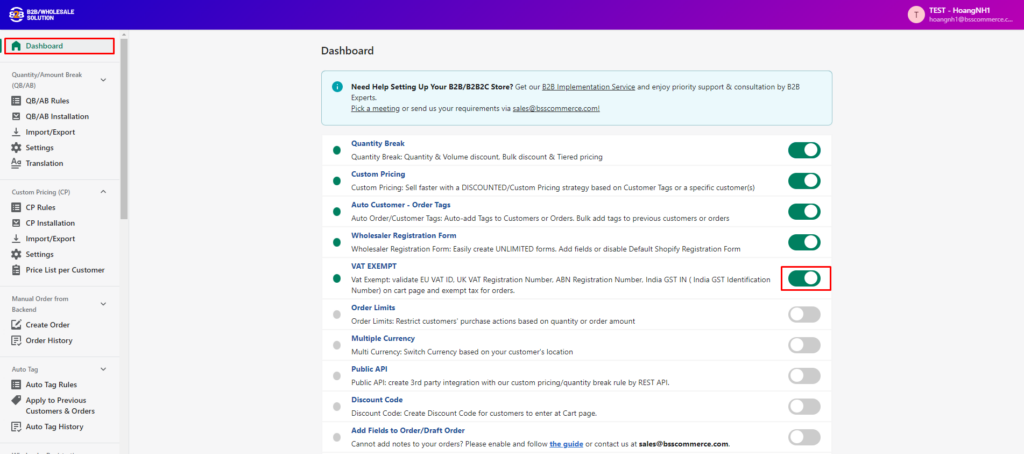

Go to Apps > B2B/Wholesale Solution > Dashboard > Enable the VAT Exempt.

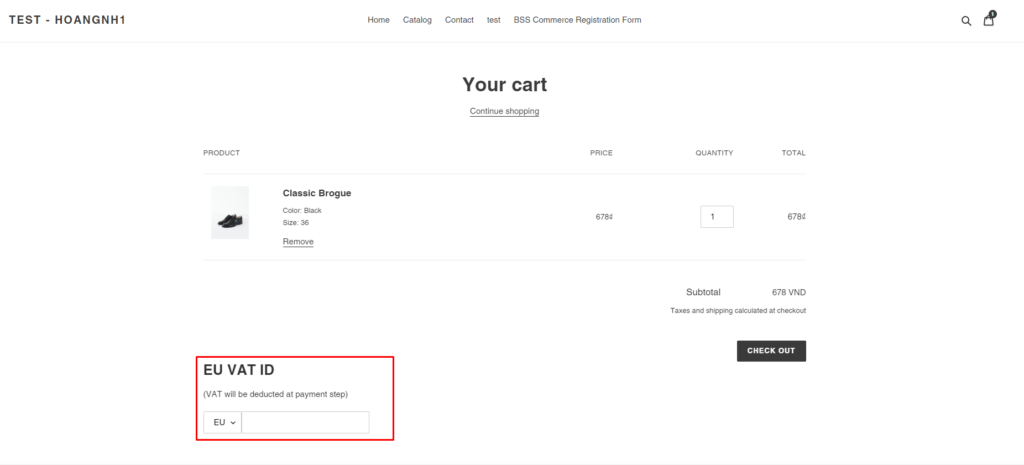

Once you enable the feature, it will be automatically applied to your cart page without any additional step.

However, if our feature does not work with your theme, please follow the steps to manually install the feature:

- Find cart template file in your theme, usually it's sections/cart-template.liquid or templates/cart.liquid

- Find <form action="" and add code snippet following below to before </form> tag

- In case you can not find these, please try to place them in any position for your purpose or contact our developer for help.

{% if content_for_header contains 'bss-b2b' %}{% render "bss-b2b-tax-exempt" %}{% endif %}

Tax Validation box is shown on the Cart page:

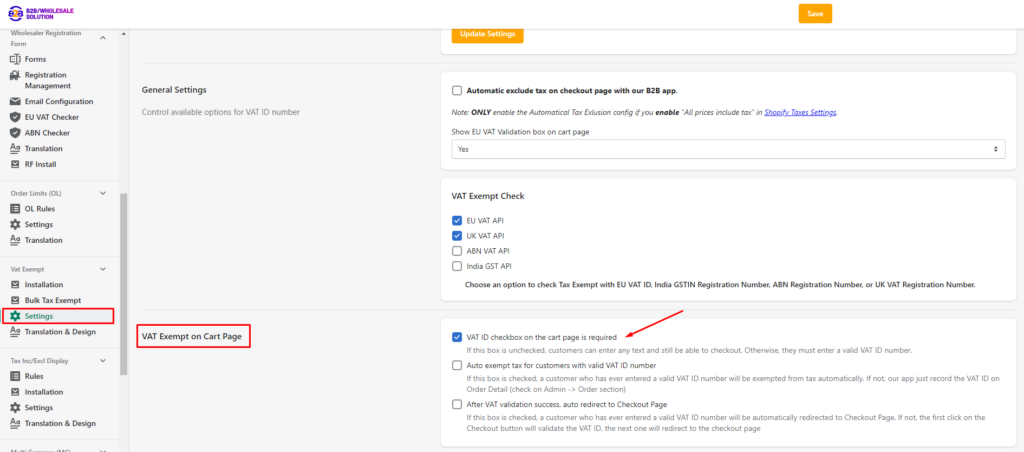

Under Settings,

You can either set VAT ID number as required or optional to checkout. If it is set as required, customers cannot checkout if they do not have validated EU VAT numbers.

Settings > VAT Exempt on Cart Page

"VAT ID checkbox on the cart page is required" is unchecked, customers can enter any text and still be able to checkout. Otherwise, they must enter a valid VAT ID number in order to checkout.

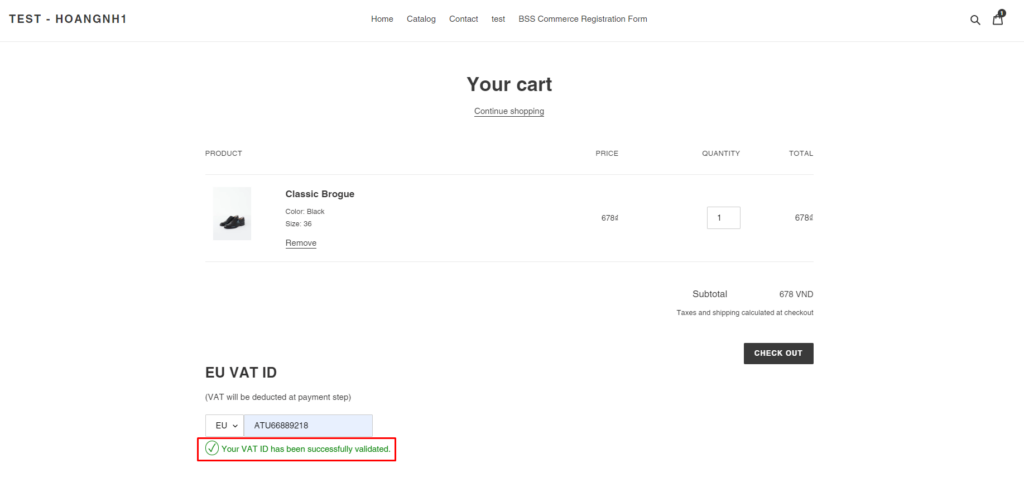

If customers type in validated EU VAT numbers, tax is already deducted from their order.

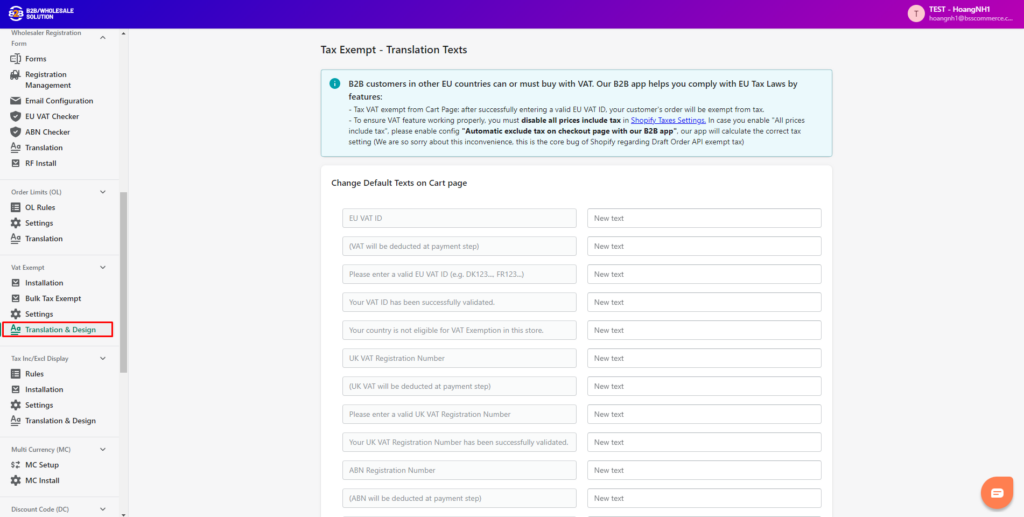

Under Translation & Design,

You can change default texts as you wish to match with your store.

If you come across any issue, please contact us via sales@bsscommerce.com for further assistance.

This feature is only available on Advanced plan ($50/mon).