1. Overview

Tax per Store View extension is a good solution for a Magento store with multiple store views when it allows charging customers different tax rates on each store view. Therefore, store owners can have very flexible taxing for particular customers on local market corresponding to store view.

2. How Does It Work?

This extension solves tax issues for each store view by allowing admin to select different Product Tax Classes with various tax rates of each product to apply for the store view level, instead of the website level as in default Magento.

Therefore, we will follow 4 steps:

- Set scope for Tax Class as Store View.

- Create product tax classes.

- Create tax rules to apply for each tax class along with wanted tax rates. Tax rate in each rule will be applied for products in each store view as you want.

- Edit Product tax class of each product per store view.

2.1. Set Scope for Tax Class

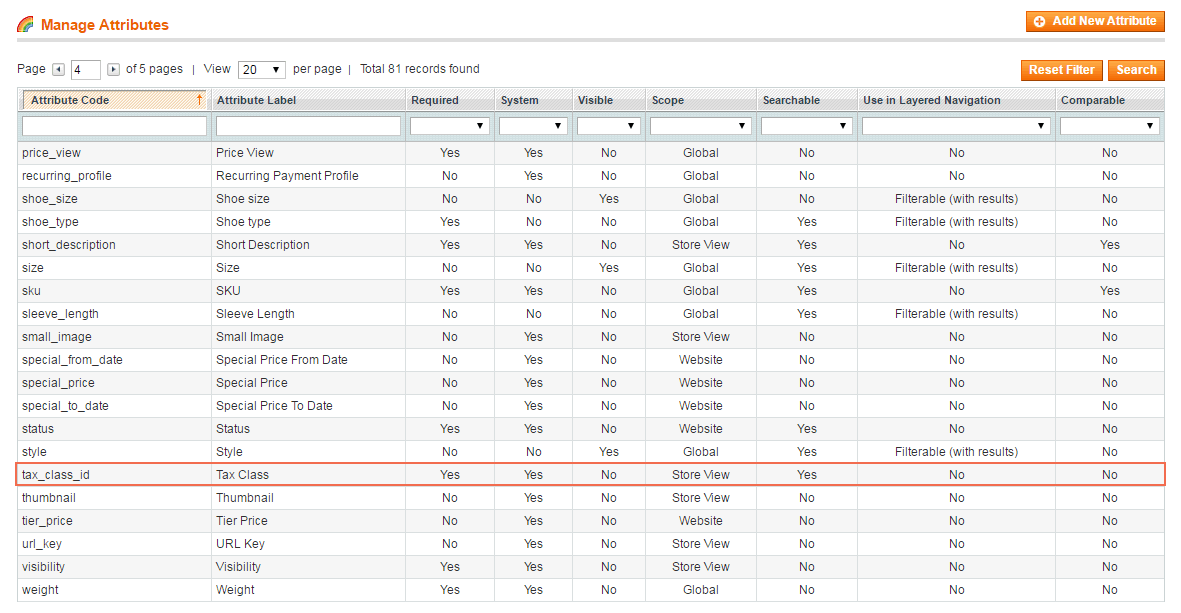

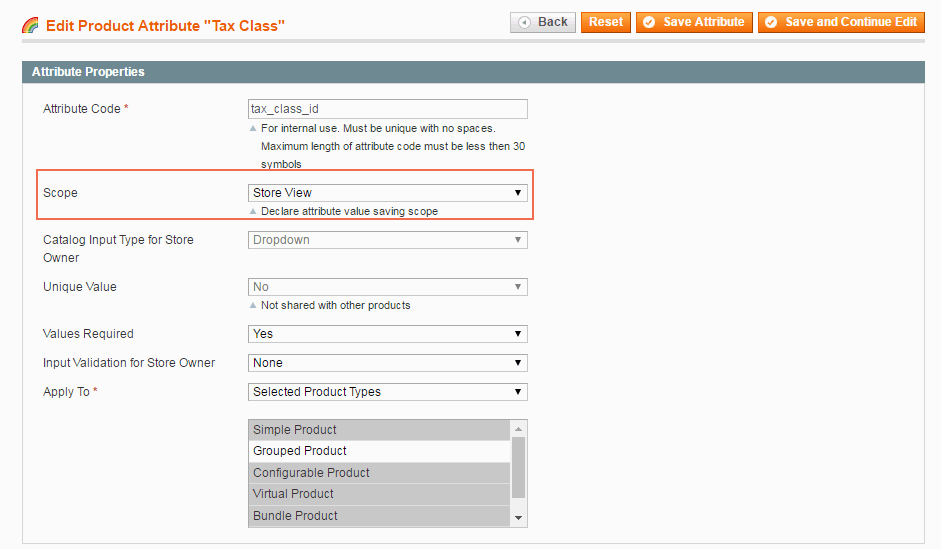

You go to Catalog ⇒ Attributes ⇒ Manage Attributes and search for Tax Class Attributes (You should search the attribute code of Tax Class or Attribute Label that you name when creating it). In this case, we search attribute code of Tax Class as tax_class_id and click to edit.

In Tax Attribute, choose Store View in Scope.

2.2. Create product tax classes

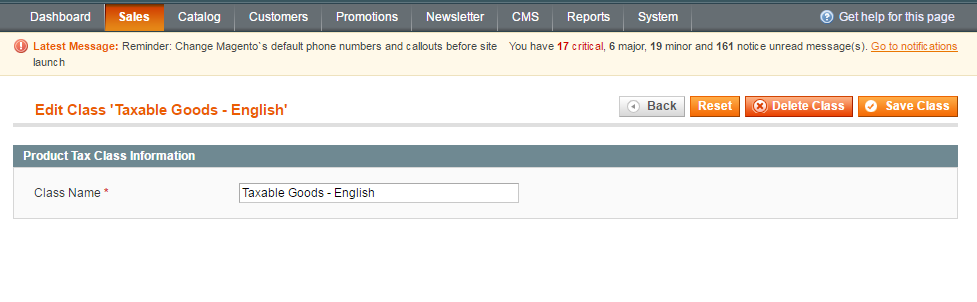

You should create a number of product tax classes corresponding to the number of store views if you want to set apply different tax classes with various tax rates for each store view.

In this case, we will create two product tax classes for English and French store view as Taxable goods-English and Taxable goods-French.

You go to Sales ⇒ Tax ⇒ Product Tax Classes ⇒ Add New.

2.3. Create tax rules

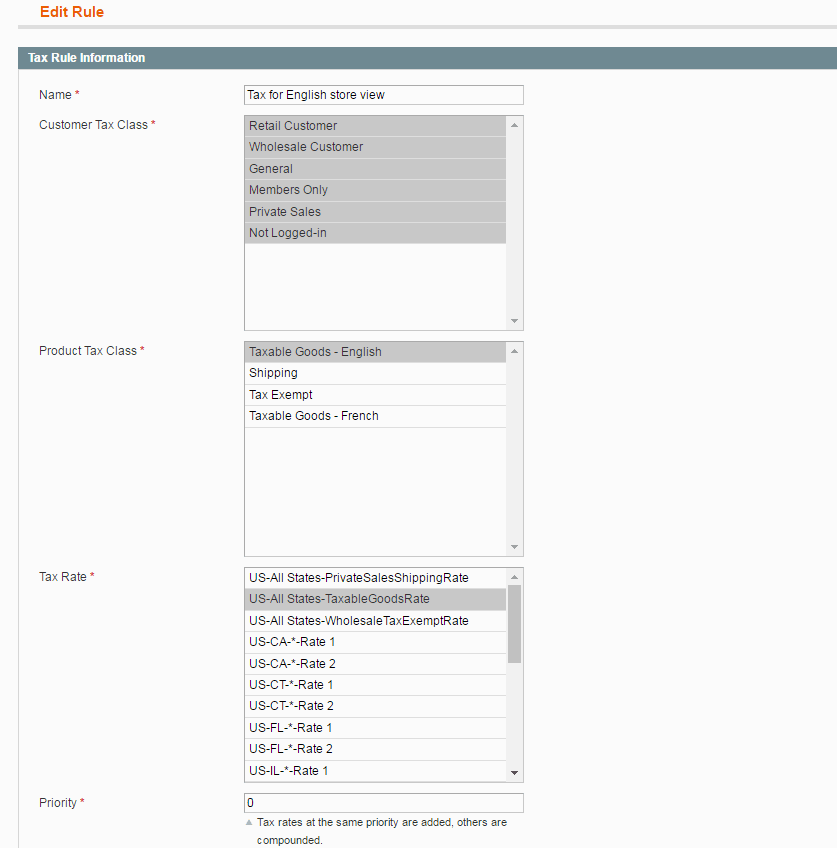

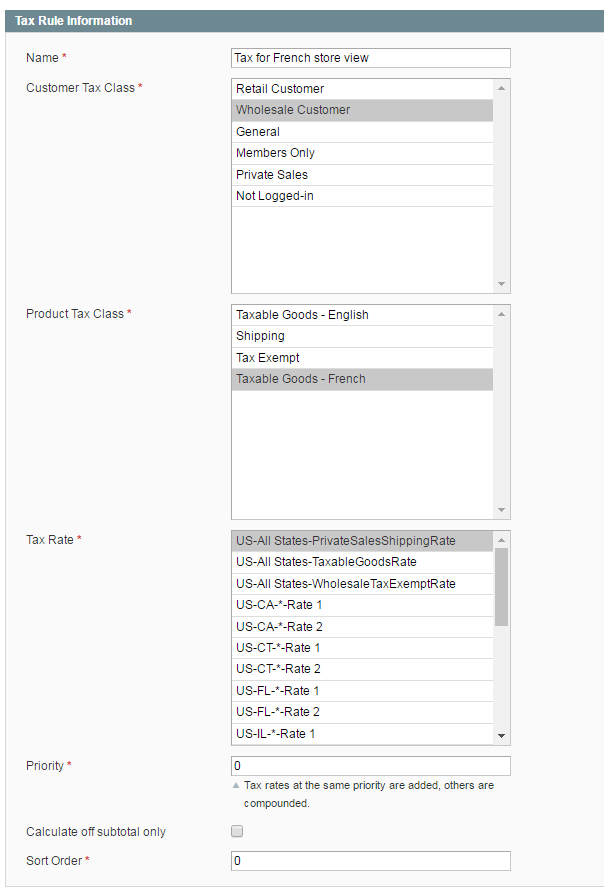

You should create suitable tax rules with your wants. You go to Sales ⇒ Tax ⇒ Manage Tax Rule ⇒ Add New Rule.

In this case, we will create 2 tax rules:

+ Tax rule for English store view with a tax rate of 8.25% is applied for the product tax class as Taxable goods - English.

In Name: name for this tax rule.

In Customer Tax Class: select customers who are charged by this tax rule.

In Product Tax Class: Select your wanted product tax class to apply this tax rule.

In Tax Rate: choose your wanted tax rate. We choose US-All States- TaxableGoodsRate with the rate at 8.25%.

You fill in other information in this Edit Rule section and then save the rule.

+ Tax rule for French store view with a tax rate of 4.92% is applied for the product tax class as Taxable goods - French.

In Tax Rate: we choose US-All States- SalesShippingRate with the rate at 4.92%.

You complete information like with English Store View and then save the rule.

2.4. Apply different tax class with specific tax rates for each product per store view

2.4. Apply different tax class with specific tax rates for each product per store view

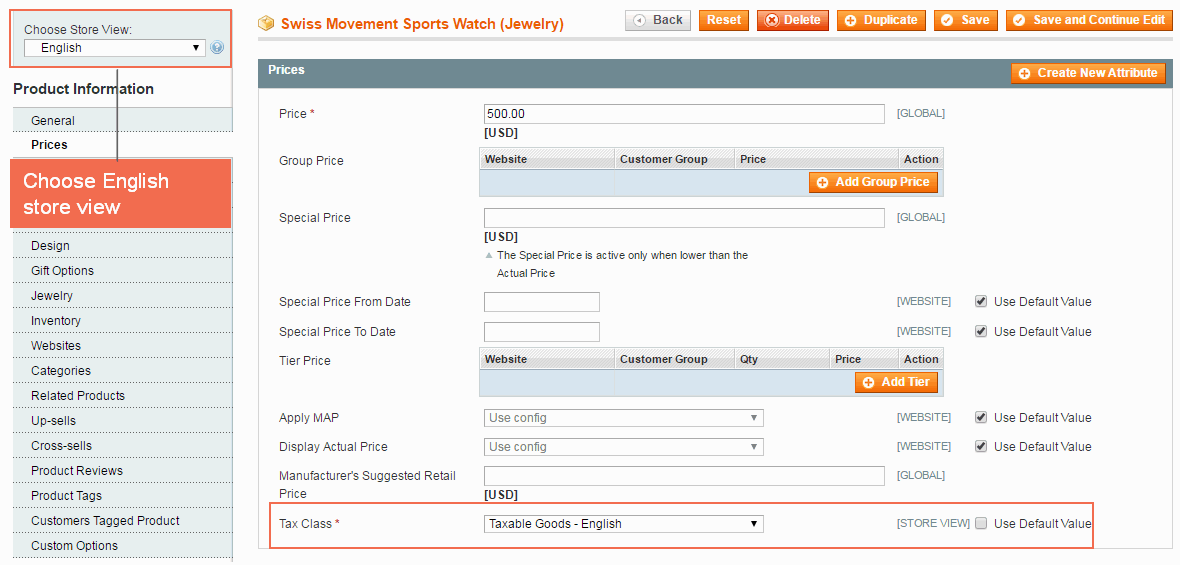

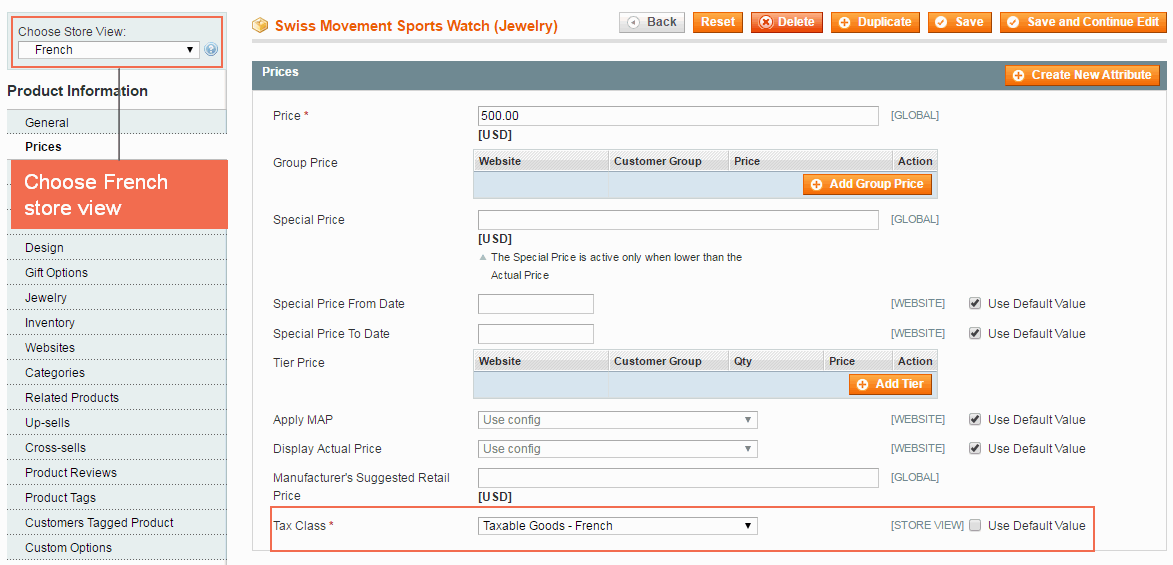

After you set up tax rules as you want, you need to edit the tax class of each product in each store view.

You go to Catalog ⇒ Manage Products ⇒ Choose a product to edit ⇒ Price and switch store view to select tax class with your wanted tax rate set up in the tax rule.

For example, we choose Swiss Movement Sports Watch.

+ In English store view, we select Tax Class as Taxable goods - English (this product tax class is included in the Tax rule "Tax for English store view" with the tax rate of 8.25%.

+ In French store view, we select Tax Class as Taxable goods - French (this product tax class is included in Tax rule "Tax for French store view" with the tax rate of 4.92%.

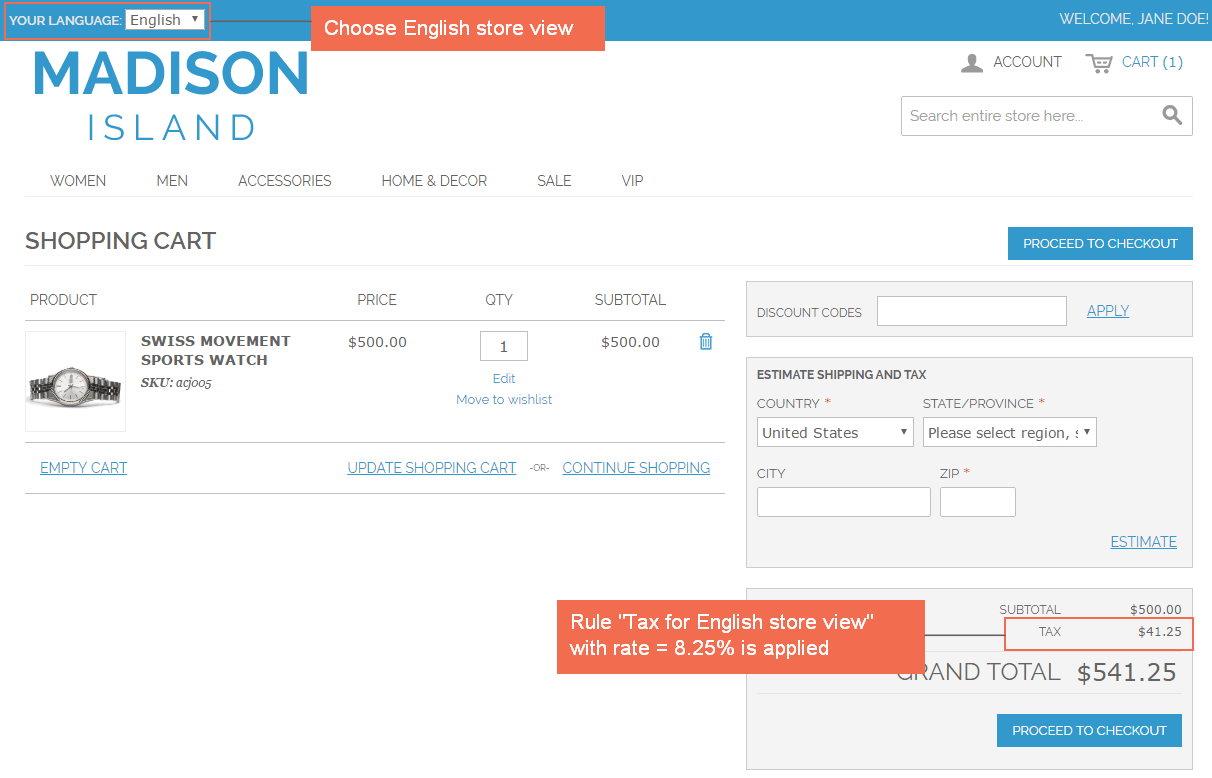

Then you go to the frontend, add product to cart and see the results:

+ In English store view: the product is taxed at a rate of 8.25%.

+ In French store view: the product is taxed at the rate of 4.92%.

3. Conclusion

As you can see, a product is taxed at different rates on various store views.