If you are a Shopify store owner based in the European Union, it is crucial to understand when to charge VAT or even which tax rate applies to which customer.

If your business is VAT-registered, you have to charge VAT to some customers, but not to others. The table below shows whom you need to charge VAT and when.

| Customers from | Consumers (B2C) | Businesses (B2B) |

|---|---|---|

| The same EU country | VAT | VAT |

| A different EU country | VAT | No VAT |

| Outside the EU | No VAT | No VAT |

B2B/Wholesale Solution by BSS can help you with it

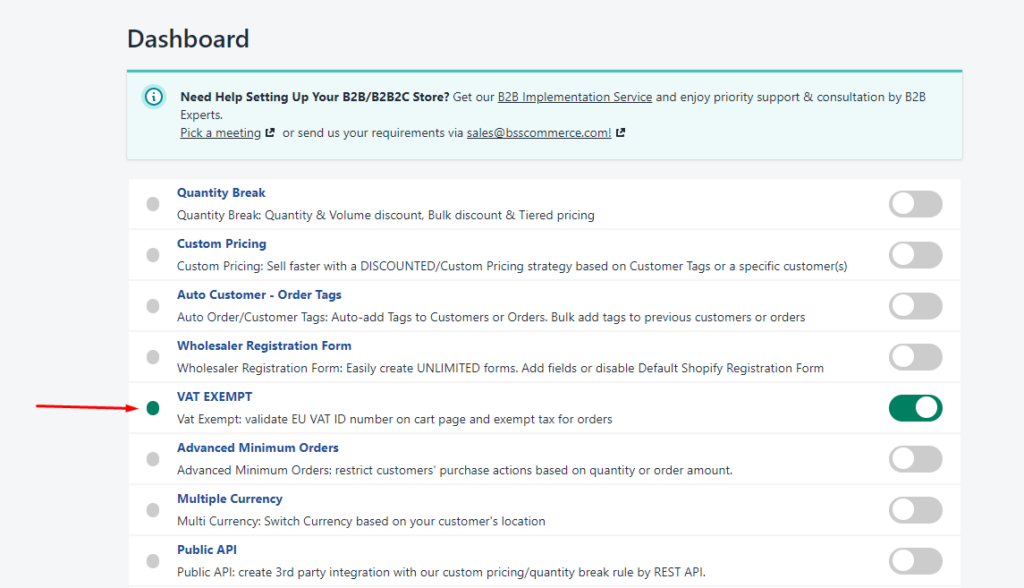

Step 1: Enable the VAT EXEMPT module in the Dashboard.

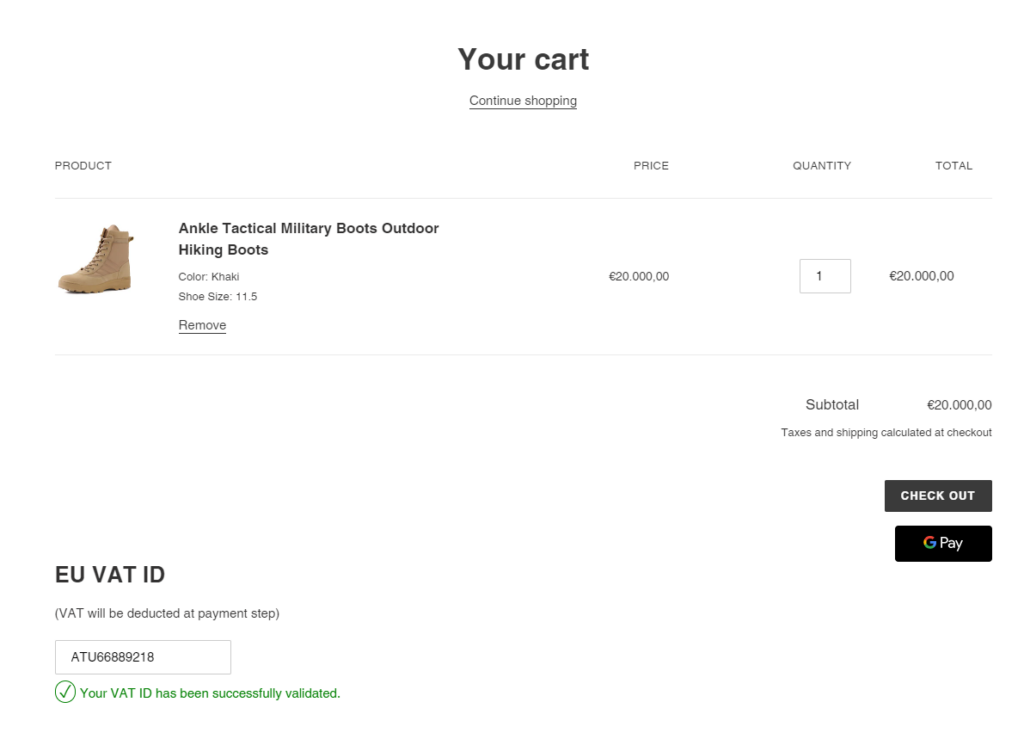

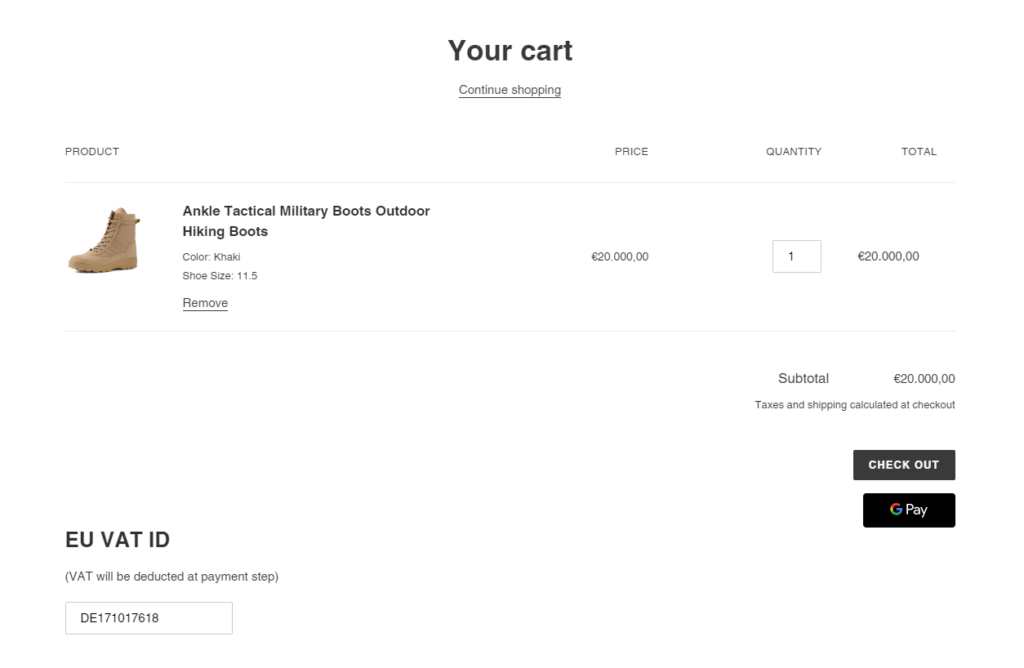

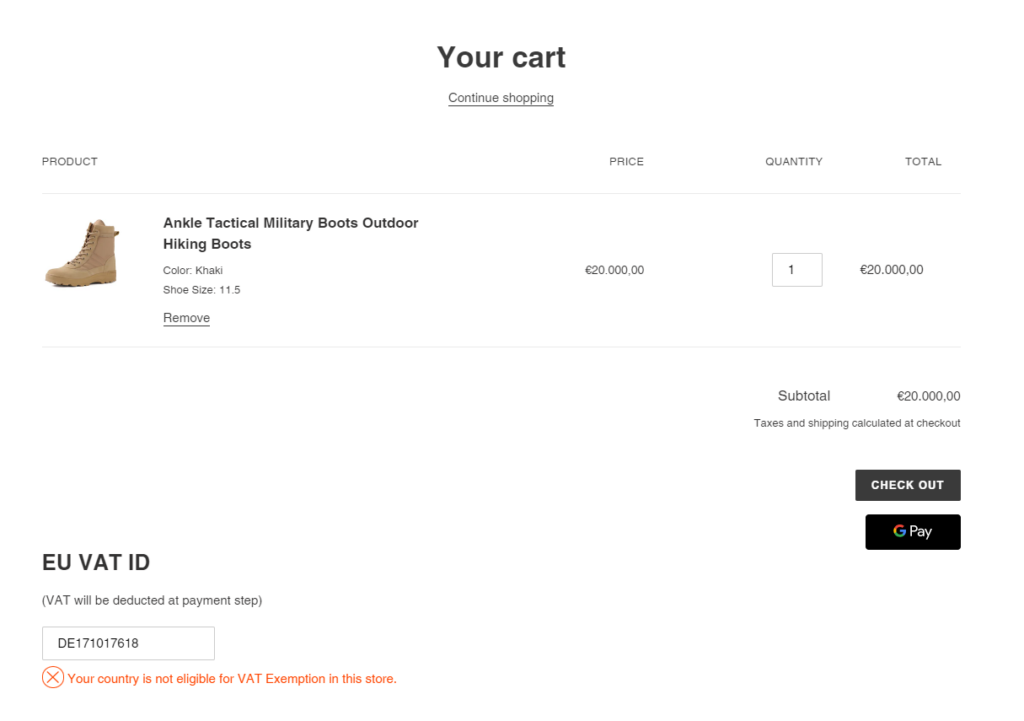

The VAT Validation box on cart page will be displayed as below.

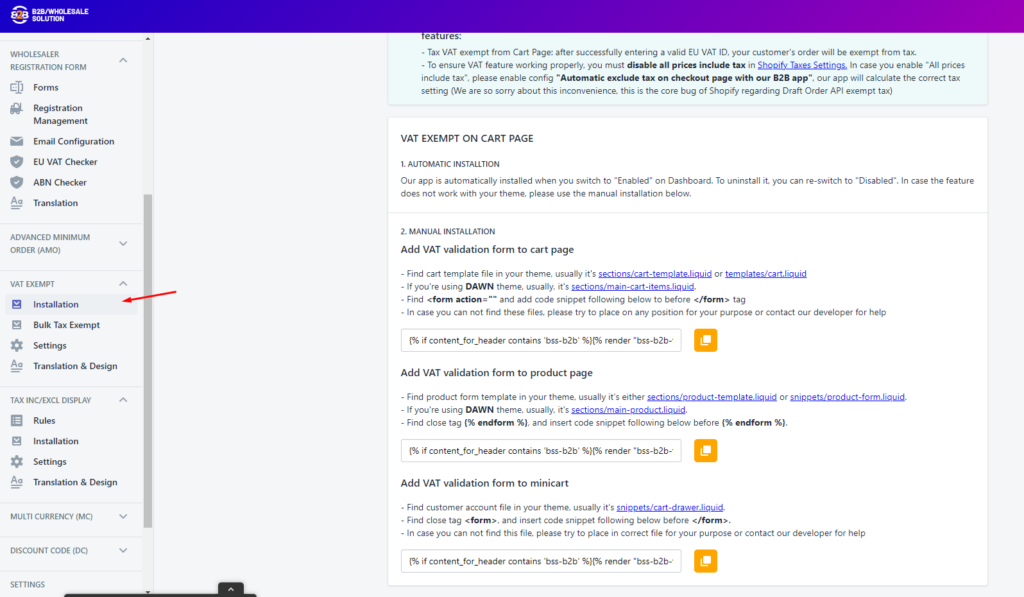

If you cannot see the box, please follow the Manual Installation Guide in the Installation tab

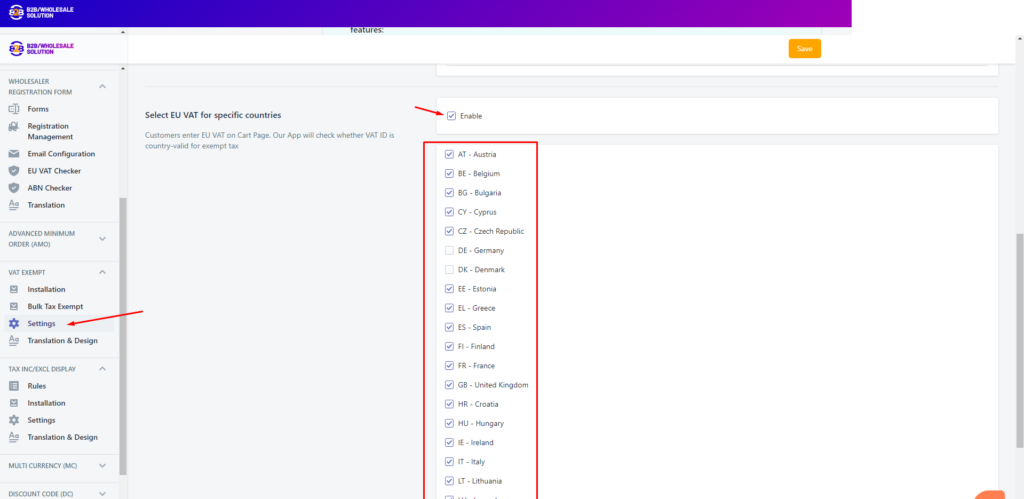

Step 2: In the Settings, press Enable for "Select EU VAT for specific countries". Untick the countries you want to collect VAT. Tick the countries you want to VAT-Exempt.

As you can see the image above:

- Customers from Germany (DE) and Denmark (DK) will be collected VAT.

- Customers from other countries in EU will be exempt VAT.

If the customers enter EU VAT Number of Germany, they will be collected VAT.

If the customers enter EU VAT Number of Austria, they will be exempted VAT.