Currently, Tax INC/EXCL Display function can calculate exact tax rate in the "Tax overrides" setting for specific collections.

Please refer to steps below to fulfill your requirements:

Because Shopify does not allow us to collect the Tax override data in the Shopify Taxes Settings, we have to create a "Tax Overrides Configuration" in our app to ensure the Tax Display correctly.

Important Note: Please setup the Tax Override again to let our app detect the configurations. Make sure this settings MUST BE THE SAME as the one in the Shopify Taxes Settings

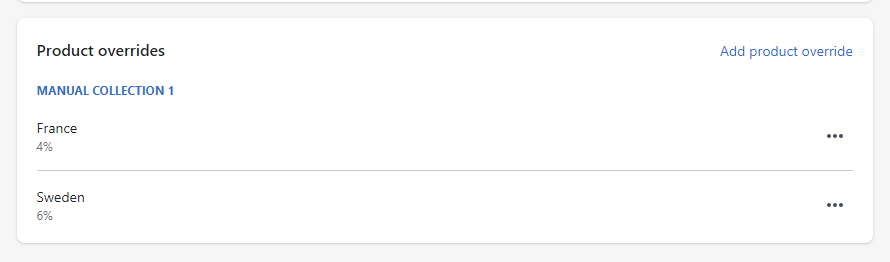

For instance, you're setting up Tax overrides in Shopify Admin as below

Please refer to steps below to fulfill your requirements:

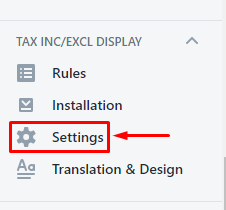

Step 1: Go to the Tax Inc/Exc Display Settings

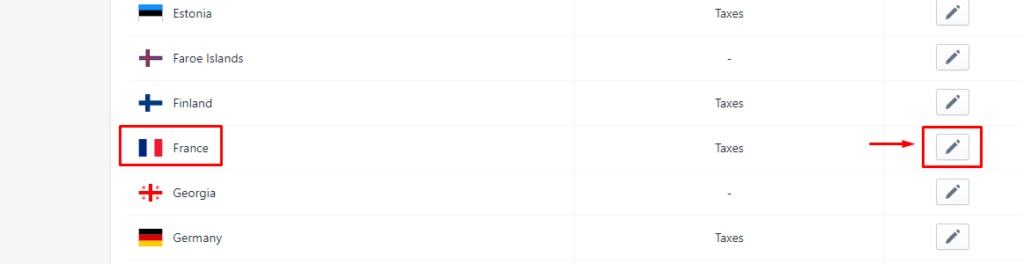

Step 2: Select the country you want to setup the tax overrides

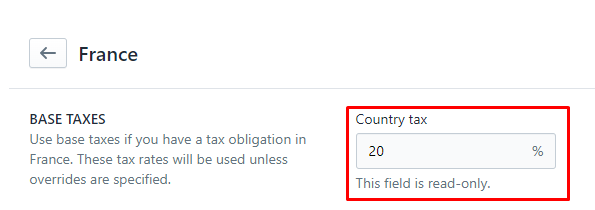

In the France Country setup, you can see the Default/Base sales tax rate

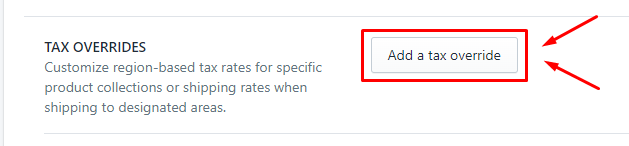

Step 3: To setup the overriden tax rate for specific collections, click "Add a tax override"

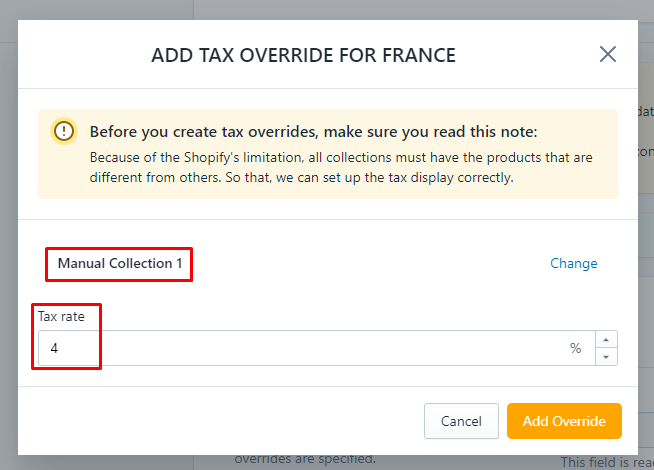

Step 4: Select the collection you set up on Shopify Admin & enter the custom tax rate

Noted: This setting must be the same as "Tax overrides" on Shopify Admin

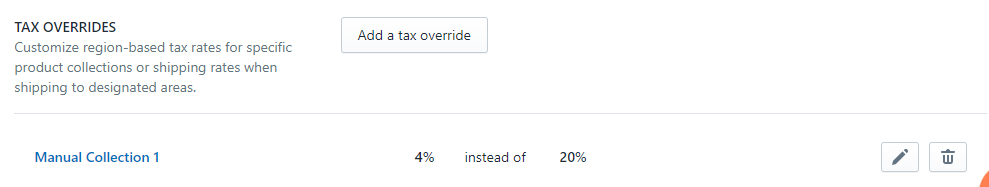

Step 5: Click "Add Override". This collection would be applied a new tax rate instead of base tax rate.

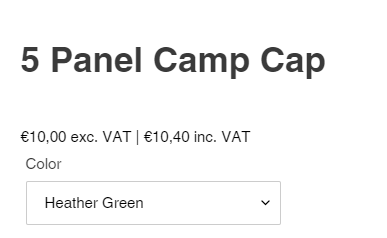

Let's check the result in the storefront:

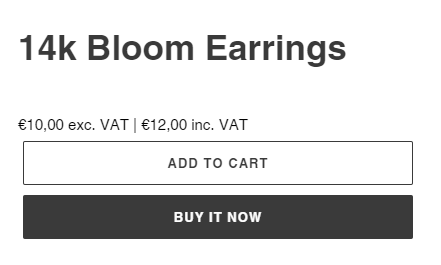

Normal product (France Base tax rate):

Tax Overrides product (France Custom tax rate):